Whether you're just starting a SaaS business or you're a veteran product manager, getting feedback from users is a top priority.

Building systems to regularly collect customer feedback will help you achieve success for your product while avoiding presumptions and misconceptions about user experience.

Product surveys and user research are vital for product managers when it comes to gathering valuable data or validating ideas and hypotheses, as well as anticipating customers' expectations .

What's more, honest feedback from properly delivered product surveys can help you illuminate all stages of the user story. Knowing those user insights can help you nurture more loyal customers. Let's dive in.

What is a Product Survey? #

A product survey is a set of questions delivered to a targeted group of your user base, for the purpose of collecting product feedback about the state of your customer experience. Product surveys help you to build a data-centric understanding of your users; this will not only benefit your company but user interest too.

Stages of The Product Survey Cycle #

Building a successful feedback survey starts with understanding the product cycle. Let's break it down into actionable steps.

Step 1: Determine research objectives #

This means you have to figure out what your learning needs are, in order to, then, define the right customer survey type you should use, and find the best survey methodology in order to gather customer feedback.

Step 2: Find the right target for your sample #

There's no need to interview everyone in your target segment. Getting a representative slice of the cake will be enough to answer your questions and get the critical data you need.

There are some probability methods you can use to set your sample:

Random: equal probability for everyone to be selected

Systematic: individuals are selected at regular intervals

Stratified: population divided into groups according to different parameters; individuals then randomly sampled within the groups

Clustered: population divided into groups like in the previous option, but then whole clusters are selected randomly

Step 3: Ask the right questions #

Depending on the type of survey you're creating (see below for 12 different customer survey types), you'll need to ask the right kind of questions. These could be open-ended or close-ended questions, multiple-choice or emoji-based questions, star rating questions, demographic questions, preference questions, emotional state questions, and more.

Examples of product feedback survey questions to ask:

How do you feel while using this new feature?

Would you recommend our product to your teammates?

How would you rate our product on a scale from 1 to 10?

Which of the following statements describes you best?

How easy was this step? How long did it take you to complete it?

So remember, when you collect feedback, asking the right survey questions at the right moment will help you gain valuable insights from your users.

Step 4: Create the first draft of your product survey #

First, you can create a list of the questions to which you need an answer. There shouldn't be more than 10-12 questions to avoid losing the attention of your respondents.

Then, pay attention to the product survey design:

How do you group the questions?

What should users answer at any specific moment?

Does the design match your brand's style?

Is the survey design going to improve user experience?

Where to position your survey and how to present it?

These are only some of the questions to consider, the definitive list will depend on the customer survey type you create.

Step 5: Choose the right user feedback tools for your product surveys #

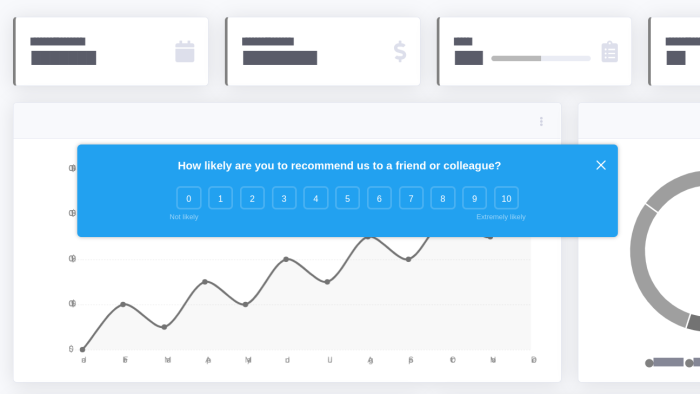

The best user feedback tools will enable you to create customized, short-form surveys that will appear within the product and illuminate responses by attaching relevant data and information, like when and where a decision was made in the user journey.

Typically you can send surveys via email or web pages through variety of online survey tools.

However, if you want to run your surveys in-product, you can use a tool that creates product feedback surveys, such as Chameleon, to create and run in-app microsurveys which will help you better understand the user's motivation and capture results that are more accurate.

Microsurveys that are delivered in context like these can better measure customer sentiment, because you'll know what the user has done immediately before answering your survey. This means you can better understand the motivation behind their answer.

Capturing user feedback at that very moment is more useful than surveying users generically about the product because:

General feedback can be vague, with lower response rate

Surveys via non-product channels may fall out of context

Step 6: Publish the product survey #

Publish (or perform) the survey respecting your user's anonymity, asking one question at a time and avoiding influencing users' opinion by how you formulate the questions.

Keep in mind that you should focus on the time needed for a response and not on the number of questions. Also, you should always give a way out in case a user doesn't want to answer immediately. This can be done in a user feedback tool by adding a "snooze" option for re-opening the survey later on.

Step 7: Iterate and improve the survey #

The first product survey you design is not going to be the only one. As in any development, you should iterate and improve based on customer feedback. Remember to include this in your goals, especially if you're just starting a business.

Maybe this time you've started with a small sample but next time you can think of widening your slice of cake.

Step 8: Collect customer feedback and evaluate the results #

Based on the survey results, that become statistics, you'll be able to infer for the rest of your target population. See if they validate or invalidate your hypotheses. Search for common points and brand new findings.

Then, act upon your insights to iterate your product and improve user experience by addressing customer issues and increasing customer satisfaction scores over time.

12 types you can use for an in-product feedback survey #

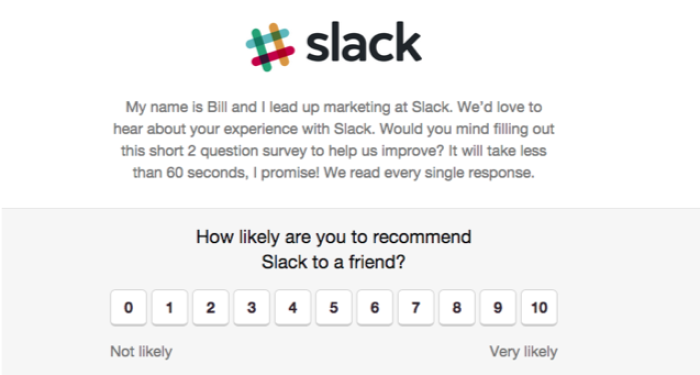

1. NPS Survey (Net Promoter Score) #

An NPS survey determines how likely a user is to recommend your product or service to a friend. This helps measure customer loyalty and identify different customer segments.

During the last decade, NPS has become a popular indicator for future SaaS growth. It's a very simple product marketing tool with many applications. It's also easy to understand for deployers and respondents and also easy to implement.

Methodology

First, you measure the net promoter scores with survey questions. You collate the answers which are on a scale of 0-10, grouped into:

Detractors (0-6)

Passives (7-8)

Promoters (9-10)

In the end, you'll subtract the percentage of promoters from the percentage of detractors.

NPS = (Number of Promoters / Total Responses) – (Number of Detractors / Total Responses)

As you can notice, the NPS survey will completely ignore passive respondents.

In addition, when you perform the customer survey, you'll optionally be asking respondents to justify their answers. This will be of help as it will point out some areas of improvement. You can choose to deploy the survey by email or by using an in-app solution.

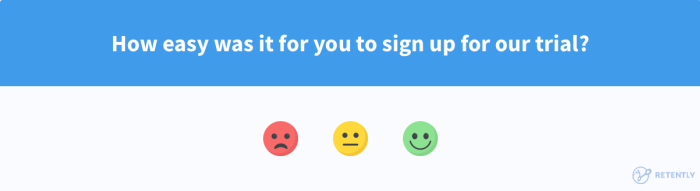

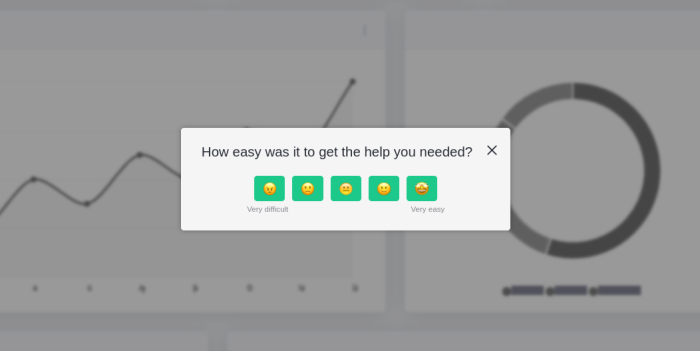

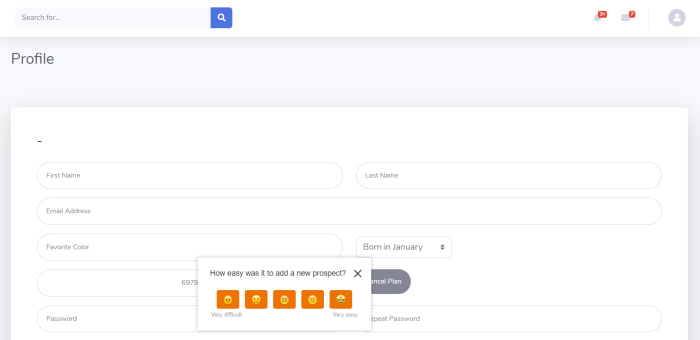

2. CES Survey (Customer Effort Score) #

The CES (Customer Effort Score) survey is useful to measure the level of effort a client has to make to interact with a company.

For instance, when they want to solve an issue, buy, or return a product. The premise here is that customers will be more engaged if the level of effort the brand requires is lower.

Methodology

The CES survey typically gives multiple-choice answers that will reflect the level of effort a customer had to exert.

Sometimes, the respondents will use a scale that goes from “very easy” to “very difficult”, but you can also see options of emojis or 1-5 scales.

According to the book The Effortless Experience:

“96% of customers with a high-effort service interaction become more disloyal compared to just 9% who have a low-effort experience”.

As a customer survey type, the Customer Effort Score should be always used along with another product survey like NPS, to better measure clients' loyalty.

The CES in-product survey should be sent as soon as specific interactions occur at customer journey touchpoints:

After purchase or subscription

After adding a new feature

After interaction with customer service

If you want to have more information, you can also ask users to justify their answers.

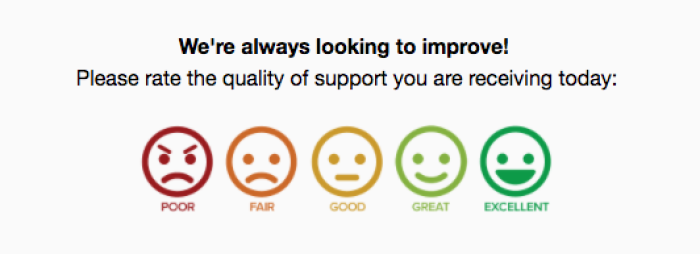

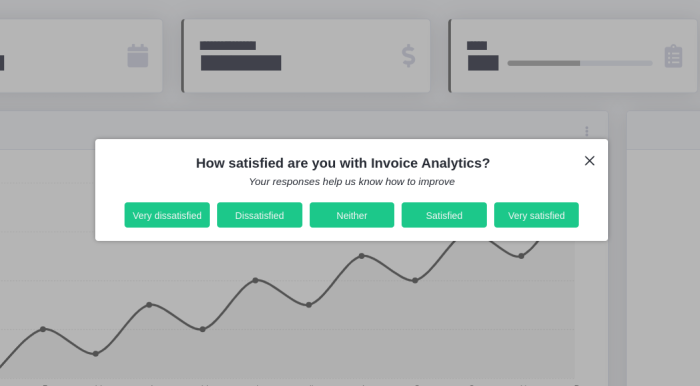

3. CSAT Survey (Customer Satisfaction) #

While CSAT's customer satisfaction survey may seem similar to the NPS, it is not. NPS measures the level of satisfaction in general while CSAT only does it for specific experiences.

Methodology

For this Microsurvey, you'll see options of scales from 1 to 5, emoji, or even phrases. You should keep it as simple as possible. The five choices measure customer satisfaction at different levels:

Very unsatisfied (1)

Unsatisfied (2)

Neutral (3)

Satisfied (4)

Very satisfied (5)

To figure out the results you'll have to calculate the following formula:

(Number of satisfied customers (4 and 5) / Number of survey responses) x 100 = % of satisfied customer

The timing of the CSAT is crucial. You should use it after specific moments in the customer journey, like:

The “aha!” moment during the onboarding

Before renewal of the subscription

During the user onboarding and activation flow

After interaction with customer service for a specific issue

After the user has performed an action and reached a predefiend milestone

As with CES, you can always dig deeper to better understand areas of improvement. Running a CSAT survey is a great way to understand how to cultivate customer love

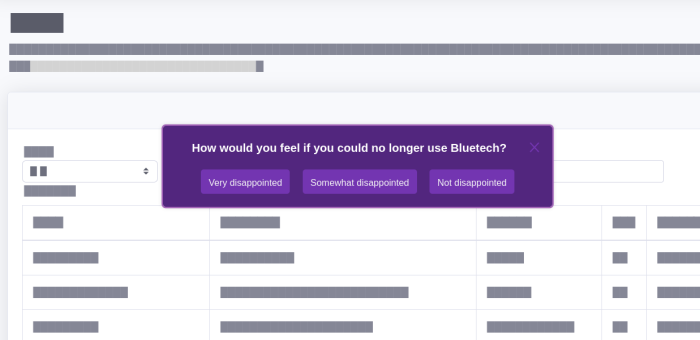

4. PM Fit Survey (Product-Market Fit) #

The product-market fit product survey is a single question survey type designed to figure out if you've achieved product-market fit for a specific user segment. This would mean you have proven your original value hypothesis. You would've proven that you were right about why a user should choose your product or service.

Methodology

With this type, you should only survey recent users (not more than two weeks after they sign up) and those who have used your product or service at least twice. You can take advantage of this product marketing survey also to segment your users more, performing the survey on different segments so that then you can continue with different actions for each of them. The question will be:

How would you feel if you could no longer use [product / service]?

The answers will be among these:

Very disappointed

Somewhat disappointed

Not disappointed (it isn't that useful)

N/A – I no longer use the product

Of course, you shouldn't use customer satisfaction surveys when it's still too early and they haven't had enough time to engage with your product. The results will be good if you end up with 40% or more of “very disappointed” users.

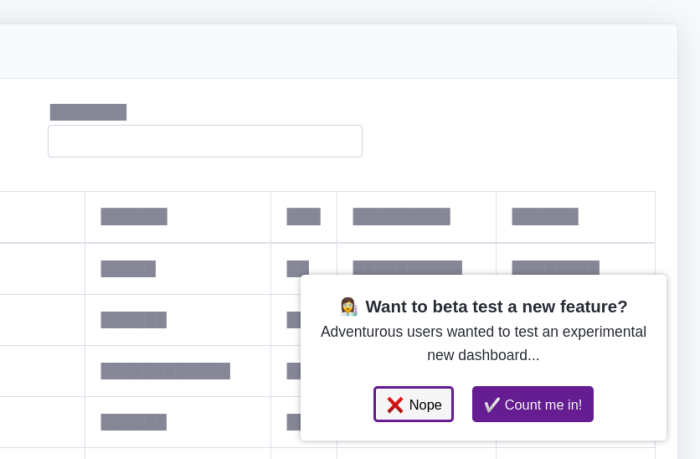

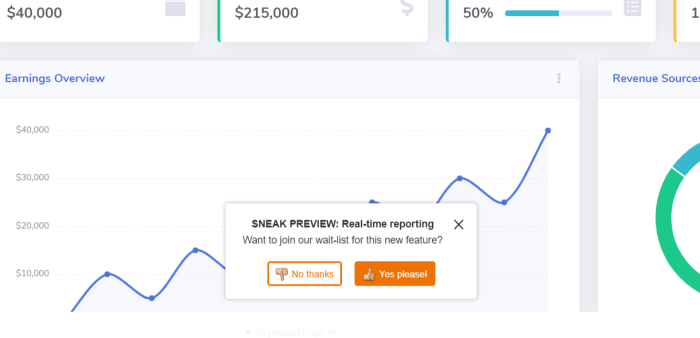

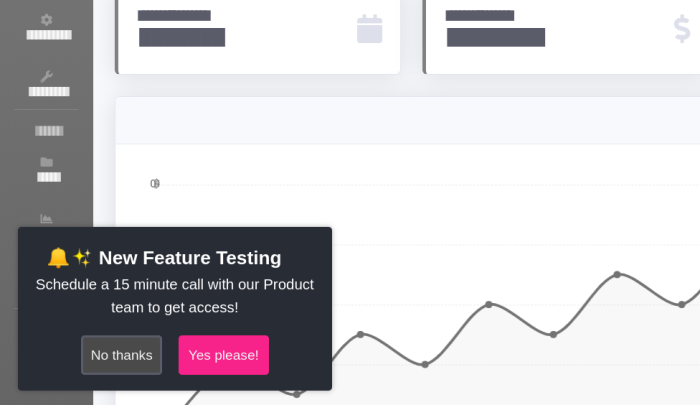

5. Feature opt-in survey #

If you are doubting about adding different new features for your product or service, you can always ask how customers feel about them. If you have a specific agreement for your users, you'll be leaving behind assumptions on what they are expecting or what they want.

Also, sometimes you'll be able to add the feature only for those who opted in. For example, this might be during the Beta phase.

Feature opt-in is as important as feature opt-out. You are focusing your efforts on the user experience and their desires and real needs.

Methodology

A feature opt-in microsurvey is asking your users specific questions about new features or improvements you want to work on.

Make sure you explain the best possible way the feature you're offering them. Explain the benefits by using your value proposition. This survey will help you get to the next phase of your product/service development.

If you have an app that helps users to communicate through chat, a feature opt-in survey could be based on asking your users if they'd like to use video calls. It will always be related to an upgrade.

An example of this would be the two-option Microsurvey:

6. Beta feedback survey #

If you want to test a product or service while gathering user feedback, the Beta feedback survey should be the one you go for.

Methodology

The usual questions you can ask are related to features, but those are not the only ones you can include. In fact, you should think about three kinds of questions:

Questions related to needs:

Why does the user need to solve the problem?

How has the user tried to solve the problem before?

The idea is to let the user speak freely. These kinds of questions are ideal to identify possible solutions or validate your value hypothesis.

“What are the benefits of this product / service to you?”

Questions related to features:

What does the user dislike?

What does the user like?

What would the user change?

These are questions designed to gather feature analytics and specific requests about features from your users.

“Who else do you think would need/like this feature?”

“How do you use the feature now? What is the workflow?”

Questions related to UX/UI:

What was the first impression the user got about the app?

How difficult was it for the user to understand how to perform an action or how to use a feature?

These questions will allow you to understand if the flow can be improved, also if the layout is optimal to find everything and if the information is clear.

“How difficult was it to upload the files?”

The Beta feedback product survey is great to find bugs, to improve user experience and to get to know better your users' potential needs and desires, while still in the early stage of development.

7. Churn feedback survey #

When you are about to lose a customer or you have already lost them, it's advisable to get some feedback, so that you can avoid losing more users or even recover the client that is willing to leave.

To improve your offering you must know the reason why the user is leaving.

Is it due to:

Some other company that's better or newer?

Is the product not efficient enough to solve the user's problem?

Is the subscription meant to target another kind of user?

Does the product present obstacles the user cannot surpass?

The churn feedback product survey is meant to help you with this matter.

Methodology

The questions should be open-ended so that the user can freely express their opinion. However, if you have hints on what the issue could be, you can also present a multiple-choice survey but, make sure to always leave one last option for the user to include comments.

“Why did you decide to quit / uninstall / cancel your subscription?”

I never manage to finish an entire movie.

I could never find a movie I liked.

I don't understand how to use the platform.

I forgot I had the service.

I don't use it enough to justify the fee.

Other (add your comment)

By identifying problematic areas, or types of issues, the churn feedback product survey aims to increase retention metrics and even to attract new users, if you finally improve your solution.

8. "Aha!" moment survey #

The "aha!" moment is an emotional positive reaction to the discovery of a feature. It can happen with the first use of the product, or even before trying it. It can also happen after the user has been using the solution for a while.

An "aha!" moment discovery survey is capable of identifying that moment, in which your user recognized the true value of your solution. This means that it will help you find out when (and why) they truly engaged with your brand.

Methodology

This customer survey type is usually designed as a free-form. Formulate the questions based on your value hypotheses. Below is an example.

Deeply understanding the "aha!" moment can lead you to better figure out how to guide new targeted users. It will be the North Star to your company. It will also be good to know if the "aha!" moment is the same for everyone, or if it changes depending on the user.

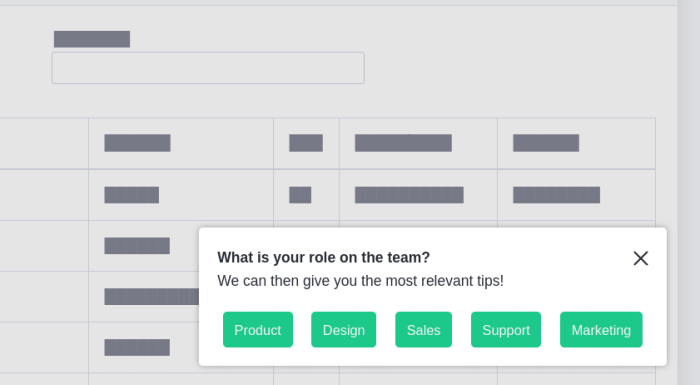

9. Persona identification survey #

The risk of failing to understand your users is big. The Persona Identification in-product survey has the goal of enabling personalization of onboarding experience. In this way, you'll create the best possible experience for each individual, or at least for a specific audience segment.

Getting a Persona Identification will help you to better know the behavioral drivers of your clients and their mindset.

Methodology

Open-ended questions will help you frame needs and motivations; 5 to 7 questions is the ideal number for this survey.

Things to consider:

What can the user tell us about themselves?

What are they using the product/service for?

Have they considered another option?

What features will be more important to them?

Here is an example below.

10. Fake door test #

The fake door test is a method of market research to prove demand for a new feature or product. Your goal with ths experiment is to measure interest at an early stage (before development) and to get feedback from users that can shape product direction. You will also be learning which is the target audience that shows interest and which CTAs or images work better.

Methodology

You can build an advertisement, button, or even website. It should always be used carefully as it could decrease credibility. When the test has finished, you should always close with an explanation of your goals and a thank you message. Below is an example.

11. Usability study recruitment survey #

Finding people to take part in user research can be tricky. If it's your first usability study and you don't know how to recruit, you should follow this process:

Screen to survey the right type of user

Schedule more users than you will need

Pay the participant users

Methodology

To screen tightly, you will need a short questionnaire that helps you select the participants that better represent your audience. This will be your product survey for usability study recruitment. A couple of ideas:

Email outreach

In product opt-in

In both cases you can feature a way to schedule the sessions, capture job title and some other variables to segment the feedback. Who do you send this survey to? If you already have current users, of course, you should take advantage.

If you are building your database from scratch, it will depend on your target. Avoid sending it to your personal database or a random volunteer beta tester list.

You should build your sample based on your users' ideal characteristics, behaviors, and attitudes. Using the power of social media advertising could be a good idea to reach your specific target audience. Below is an example.

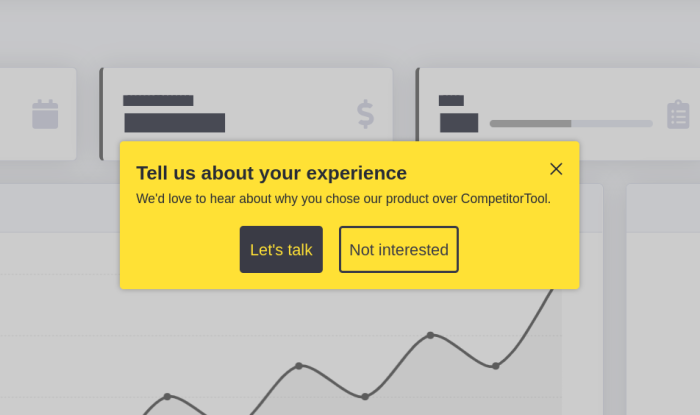

12. Competitor usability testing survey #

To better understand the product you need to build, you can create a competitor usability testing survey. This process will help you know the competitors' area of improvement (that you can take advantage of), your targeted users' mindset, and some other insights about your value proposition.

The methodology is exactly the same as if you were performing the usability testing for yourself, but made upon a competitor. The idea is that sometimes, just a little upgrade you can perform on a product idea will make a substantial difference to the user.

Don't forget to leave room also for users to give feedback about your surveys, so the next time you'll improve your user research methods or find more suitable user feedback tools. Below is an example.

Conclusion #

A continuous collection of user feedback is one of the best strategies your product team can use to gather feedback to drive product growth. Using various customer survey types and user feedback tools to run contextual in-product surveys can be a significant addition to your product and UX tweaks, iterations, and improvements.

The type of product survey will depend on your needs and goals you want to achieve. With the 12 survey types we outlined here, there are plenty of choices for you to start.

Once you decide which survey type to use, the next steps will include segmenting users, choosing the right type of questions, designing surveys to drive more engagement, and then analyzing data, evaluating results, and identifying areas for improvement.

Run product surveys with Chameleon

In-app Microsurveys allow you to capture important user feedback when it's most relevant