Sustainable growth is a real challenge for SaaS companies. The fierce competition in the sector makes it extremely hard to keep up the pace and unsatisfied customers can churn in the blink of an eye, leaving you with concerning projections.

Future performance is essential because, unlike other business models, SaaS companies heavily rely on recurring revenue and long-term, loyal customers to survive. To perform and succeed in the SaaS world, you need to have your eyes on various metrics—but which ones are the most important?

Here's how product leaders use metrics to measure success...

9 SaaS metrics to always keep in mind #

Sometimes tracking business metrics feels like playing rock, paper, scissors—an arbitrary game that makes you look like a winner or loser with no real groundings and no real insights on how to move forward. Now, not every metric will suit the set of data you need to make the proper decisions for the type of business you conduct.

Here are the 9 key SaaS metrics you definitely need to smartly steer the wheel towards the profitable side of the industry:

SaaS Metric #1: Monthly Recurring Revenue (MRR) #

Monthly Recurring Revenue is one of the most important SaaS metrics and measurements. It gives you a consistent and predictable way to view the revenue your customers are generating per month.

MRR is a momentum metric. It tells you how much your company is earning now, but also how much it’s growing over time. When you gain subsequent months of consistent MRR, this allows you to make accurate financial forecasting and build an estimation model to make future business decisions. Here’s the magic formula ft. ARPA, which we’ll explain in more detail later on.

MRR = Total # of Paying Accounts x Average Revenue Per Account (ARPA)

If your MRR is looking good, that means you are nailing two of the most important strategies your business needs to take off—customer retention and monetization. If your Monthly Recurring Revenue isn’t enough to sustain operations, or if your growth rate doesn’t increase month over month, you have to act quickly to check out if you’re properly targeting users. Cohort analysis can come in handy here as well to monitor user behavior in set time periods as well as to reconsider pricing strategies—Microsurveys can help you to get contextual feedback on how your users feel about your billing options.

To make your MRR grow at a steady pace, the key lies in a customer-centric offering, putting special emphasis on cross-selling and up-selling to make your existing accounts grow—without forgetting to acquire new ones.

SaaS Metric #2: Annual Recurring Revenue (ARR) #

You’ll get your Annual Recurring Revenue, a.k.a. “run rate”, by multiplying by 12 your Monthly Recurring Revenue. Like MRR, this financial SaaS metric allows you to plan for the future, but this time with a longer-term focus.

ARR = 12 x MRR

If your company has an ARR over $10M (woop, congrats!), it’s advisable to always look at the recurring revenue annually. But if it’s smaller, try to keep track of expected revenue every month. Just like MRR, a “bad” ARR reflects the impossibility to make the business self-sustainable.

If you want to improve your company’s ARR (this also applies to MRR), here are some recommendations:

Focus on increasing the quality of your leads and future accounts

Increase your retention rate by reducing product friction

Increase your revenue with current customers by offering them upgrades and upsells within your product

Work on an efficient acquisition strategy with the lowest Customer Acquisition Cost ( CAC) possible—jump to metric #5 for more on CAC.

SaaS Metric #3: Average Revenue per Account (ARPA) #

You’ve seen this one before in the Monthly Recurring Revenue formula. The Average Revenue per Account, as its name states, it’s the revenue generated by each account, most commonly calculated on a monthly basis. In certain cases, where every customer corresponds to just one business account, it’s equivalent to the Average Revenue Per User (ARPU) or the Average Revenue Per Customer (ARPC) metrics.

ARPA = Total Monthly Recurring Revenue / Total # of Paying Accounts

MRR and ARR are directly related to ARPA, definitely, but what’s key about ARPA is that it emphasizes the importance of upgrading the existing account and improving the quality of new customers. If you keep acquiring new customers but they give you less profit than your old ones, your ARPA will drastically decrease. A fixed ARPA month-on-month will also sound the alarm of stale business growth.

SaaS Metric #4: Lifetime Value (LTV) #

SaaS Lifetime Value measures the total revenue generated by a customer during the lifetime of their account. This is one of the smartest SaaS business metrics out there as it gives you a long-term perspective of a product’s health in terms of revenue and customer retention.

Now, everyone who lives and breathes SaaS knows that the secret formula to success lies in engaged, valuable customers—and LTV measures exactly that.

How to calculate SaaS LTV? There are a lot of different formulas for calculating LTV, the most basic form being:

LTV = ARPA / Revenue or Customer churn

But that can cause ups and downs in your data tracking. To go one step further and avoid abrupt peaks and troughs, here’s the advanced SaaS LTV calculation we recommend:

LTV = ( ARPA * Gross Margin % ) / Net Revenue Churn Rate

Gross Margin = Total Revenue - Cost of Goods

Gross margin % = Customer Gross Margin * 100 / Gross Margin

Net Revenue Churn Rate = (Revenue Lost in a period - Upsells in the same period) / Revenue at the beginning of the period

Note: If you're not sure how to calculate your gross margin, you can use a gross margin calculator.

SaaS LTV is a particularly important metric because it combines the power of:

ARPA: It shows how much your customers are paying for your offering

Customer retention rate: Whether or not users are going to stay with you in the future

Revenue retention rate: This shows if your customers are upgrading or downgrading, paying more or less over time

A growing or declining SaaS Lifetime Value brings a more complete picture of the health of the relationships you have with your customers. Here’s our advice on how to get your SaaS LTV booming:

Build add-on value into your product, focused both on increasing revenue and retention

Expand your product line to attract new customers but also add cross-selling opportunities to current business relationships

Encourage customers to sign up for a discounted annual subscription instead of a monthly one

Master scalable pricing, offering cheaper and more expensive alternatives depending on the solvency and loyalty of customers (once again, don’t forget to segment and deeply understand your customer base).

SaaS Metric #5: Customer Acquisition Cost (CAC) #

This metric measures exactly how much it costs to bring new customers to your business, taking into consideration your spending on sales and marketing—including salaries and other related expenses, over a certain time. Calculating customer acquisition cost is essential for early-stage SaaS companies and companies with freemium models because it helps gauge the sustainability of your acquisition process in regard to the profitability of your business.

CAC = Total Expenses to Acquire Customers (over a period) / Total # of Customers Acquired (during that period)

Balancing your CAC is a subtle exercise. You need to spend money on it to assertively win new customers and future revenue but, at the same time, you can’t go full Oprah on it (“you get an ad!”), otherwise, your company won’t be profitable. And this is particularly important when you’re testing and strengthening your business model. At first, you’ll need to spend more than your monthly revenue to acquire customers but you’ll have to recover your CAC within the first year if you want your business to stay healthy.

SaaS Metric #6: Customer Churn Rate #

Customer Churn Rate, a.k.a. Attrition Rate, measures the rate at which customers leave your service over time. The lower this number is, the better for your business. For SaaS companies, churn is something to put special attention to, keeping customers is as important as acquiring new ones for your business sustainability.

Customer Churn Rate = Total # of Customers That Left (in a period) / Total # of Customers (at the beginning of the period)

This SaaS metric gets more important as your company grows over time. In the beginning, replacing a small number of customers is far easier than when a 3% churn turns into thousands of customers—it’s tough. Churn also compounds over time, which means that a 3% monthly churn rate translates into a 31% annual churn rate as your pool of potential customers shrinks.

Besides, keeping your customers engaged is more cost-efficient. It will only cost you one-seventh of what acquiring a new customer costs. The recipe for reducing churn and improving retention has just two words: customer engagement.

SaaS Metric #7: Net MRR Churn Rate #

More on churn—yep, there are a lot of ways to calculate it. This one is a very useful metric: Net Monthly Recurring Revenue Churn Rate, which is the measurement of how much revenue your business loses (due to strict churn or account downgrades) month over month. It is net because it also subtracts expansion MRR to have a more accurate calculation:

Net MRR Churn Rate = (MRR Churn - Expansion MRR) / MRR (at the start of the month) * 100

There’s no need to say that less churn is always better. Ideally, your Net MRR Churn Rate should be zero or negative to see the full impact of the new MRR on your business. If you achieve this goal, you can be sure you're targeting the right customers and succeeding with your product value proposition. Nevertheless, always try to look at this metric alongside Expansion MRR and Gross MRR Churn Rate—otherwise, you can get misled by the way it combines cancellations and expansion without further distinction.

SaaS Metric #8: Activation Rate #

For a SaaS company, this metric is key. Even more, it has a product-led growth model, in which the improved user experience is the main force behind business growth. You can obtain Activation Rate is a very straightforward calculation, as long as you know which is the “aha! moment” for your product:

Activation Rate = # of Users Who Performed the Activity / ( Total # of Users * 100 )

The activity included in the formula (the moment of activation) varies from product to product, and it’s defined by the moment in which your customers realize for the first time your product is valuable to them. Identifying the activation moment is essential, and for that, you’ll need to be user-centric, here are a few ideas on how you can boost your activation rate:

Carefully design user journey maps

Get user feedback through microsurveys

Analyze behavioral analytics and cohorts

Optimize your user onboarding to shorten the time it takes for new users to activate and never stop thinking about ways to make your product better for the customers.

SaaS Metric #9: Net Promoter Score (NPS) #

Net Promoter Score is a way to directly measure your customers’ perception of how satisfied they are with your product. In other words, NPS is a tool to collect qualitative customer feedback to find the strengths and weak points of your product, but also to find the right target fit.

To calculate NPS you can survey your customers with a question like:

“How likely are you to recommend us to a friend or colleague?”

They can answer on a scale from 1 to 10, with 1 being the least likely and 10 the most. If they answer from 1 to 6, they’re called a Detractor. If they select 7 or 8, they’re neutral, and if you get 9 or 10, you’ve just found a key promoter of your product! Then, the calculation goes like this:

NPS = (# Promoters - # Detractors) / Total # of Surveyed Customers * 100

From this calculation, you’ll know which customers are so happy with your product that can be potential case studies for your business, or which of them are about to churn—that’s the time for you to work on a retention strategy to get their positive attention once again.

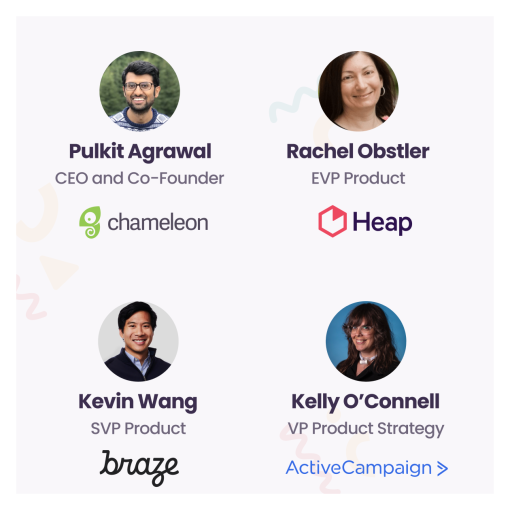

🎬 Webinar: Product Trends - Leadership Roundtable

Join our panel discussion with SaaS product leaders to help you strategize and scale in 2022 and beyond.

How to know when your SaaS is succeeding #

We've covered 9 key SaaS metrics. But how do you put them into practice? It can be a bit overwhelming if you want to follow all of them at the same time, without any given criteria. To not send you into a data spiral, here’s a checklist of what you should be looking at to know if your SaaS is succeeding:

An LTV is at least three times higher than your CAC. It’s obvious that you should be making more profit from your customers than the cost to acquire them. But, to have a successful SaaS business model, your LTV and CAC should match the following relationship: LTV > (3 x CAC)

The recovery of CAC within a year. In general, many successful Saas companies can recover CAC in five to seven months. A longer payback period will be unsustainable in terms of capital and acquisition efficiency.

At least 30% of the revenue is generated from expansions. As we mentioned many times before, having a thriving SaaS business relies a lot on how much your customers love you, and how much they are willing to invest in their relationship with your product. Stay aware of how much of your revenue comes from loyal growing accounts.

After checking these three boxes, you can proudly affirm that your SaaS business is a shiny one.

Keep your eyes on the prize: Monitoring your metrics #

To wrap up, here’s a list of SaaS analytics tools to view your metrics in an understandable way. Never forget that these metrics are the compass on the path to your company’s success. They will help you make the right decisions during the early stages when adjusting your business model is substantial, and later on, when the proportions and complexity of your customer base are bigger (as well as the impact of potential churning).

You need to keep an eye on them on a weekly/monthly basis to stay ahead of the curve, and on longer periods to gracefully forecast. Your business will thank you for it.

Weekly advice to make your product stick 💌

Be the first to get the latest product best practices and resources