AARRR vs. RARRA—no, we’re not talking about the next Lady Gaga hit—we’re talking about which of these models is best for your product growth strategy.

Whereas AARRR has been a fan favorite for over a decade, there’s a new contender on the market—RARRA is making some pretty hefty waves in the SaaS community.

In this article, we’ll recap on the AARRR framework, and why many SaaS companies are kicking pirate metrics to the curb for its more exciting upgrade.

We’ll look at where the AARRR funnel is failing product-led growth teams, and why. Lastly, we’ll cover some defining RARRA and AARRR metrics to help you understand which of these are the best fit for your product.

AARRR relies on a traditional conversion funnel to track marketing efforts

AARRR is perfect for teams shooting for acquisition-first goals

RARRA focuses on customers’ loyalty and retention

RARRA sees SaaS product teams invest in retention for growth

What is AARRR? #

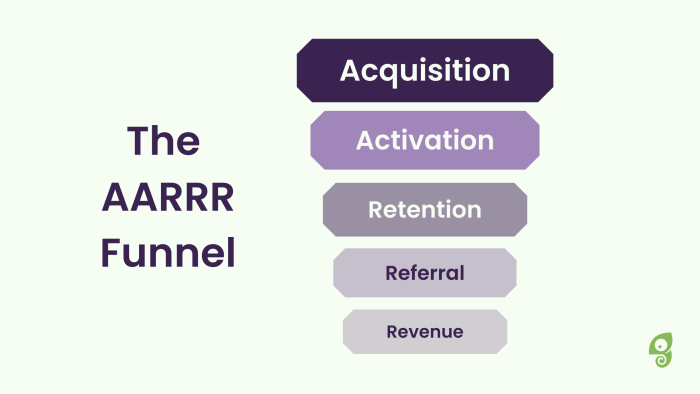

AARRR is an acquisition-first funnel. It prioritizes five growth stages for SaaS business success: Acquisition, Activation, Retention, Referral, Revenue. For short: AARRR.

The AARRR growth funnel enables SaaS brands to manage and track the success of their product marketing efforts.

Coined by Dave McClure in the late 2000s, most SaaS marketers are now familiar with McClure’s Startup Metrics for Pirates presentation. If you’re not, let’s break down each stage of the funnel.

The AARRR funnel includes:

Acquisition: Driven by landing conversion rate optimization, SEO strategies, PR tactics, paid advertisements, and sales activities. Success metrics for acquisition are often landing page visits and conversion rates, form completions, MQLs/SQLs (although what deems as qualified is always up for debate), product signups or app downloads, new users, or ad clicks.

Activation: Driven by customer onboarding tactics and profile creation flows. Activation success metrics are typically new account creations, low churn rates, or a certain amount of predetermined in-app activation steps completed.

Retention: Driven by customer success teams, self-serve knowledge hubs, stellar UX/UI, and clear brand communication. Retention success is often measured by the number of active users (daily, weekly, monthly), and retention rates (monthly, quarterly, annually).

Referral: Often driven by stellar referral campaigns. We know you’re all thinking Dropbox, but there are plenty more great campaigns out there. Ratings and reviews, social media followers, and PR campaigns are also strong drivers of this metric. Core referral metrics to track are NPS scores, referred customers—either via a code or a UTM link, organic brand-name searches, word-of-mouth referrals, and organic social media follower increase. Referrals are a sure-fire sign of reliable product growth.

Revenue: Driven by returning customers, new customers, repeated contracts, product plan upsells, and feature cross-sells. Business growth metrics for revenue are monthly recurring revenue (MRR), annually recurring revenue (ARR), and customer lifetime value (CLTV).

There you have it, the pirate metrics that many SaaS brands rely on.

However, some companies have noticed that AARRR metrics are becoming less effective in the Product-Led Growth (PLG) world. Of course, you can still rely on this user acquisition model—it solely depends on your growth plan, and how you’re measuring growth.

Why is the AARRR framework becoming less effective for PLG products? #

The market has changed a lot since McClure introduced the AARRR pirate metrics. Especially when it comes to product-led B2B SaaS, you’re now facing extended customer expectations while operating in an overly-saturated world, struggling to find airtime on anyone’s screen, no matter how much you’re investing into ads.

At the same time, the traditional pirate metrics often rely on the handholding of sales teams for growth. This means, no matter how much you streamline and optimize a sales flow, it can only go as far as the size of your sales team can take it.

In fact, many are disregarding this framework because it’s a buyer journey or a customer journey-focused approach. This means it focuses on winning paying customers. It looks at metrics like customer acquisition cost as a KPI for your SaaS growth strategy.

What’s wrong with the above? It stops when someone becomes a buyer, and SaaS requires continuously active users. It requires user journeys, or, lifecycles.

Now, let’s take a look at the new kid on the block.

What is RARRA? #

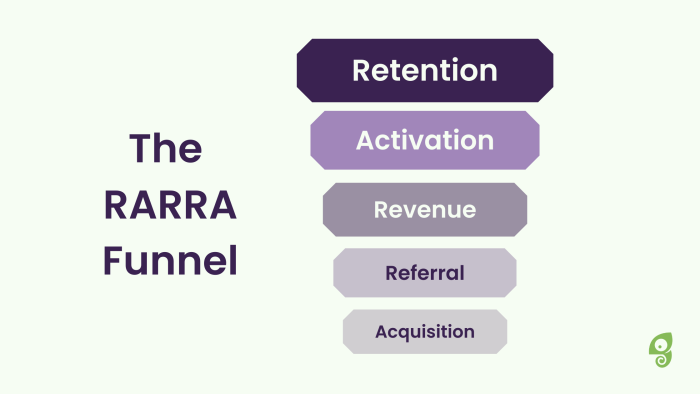

RARRA is the retention-first framework. It flips AARRR on its head by looking into: Retention, Activation, Referral, Revenue, Acquisition. This revised model prioritizes retention over everything else, it celebrates revenue in the middle of the funnel, and all of your efforts lead to the further acquisition.

Gabor Papp and Thomas Petit initially created this new version of the pirate metrics to better serve the struggles of retaining mobile app users. However, many PLG companies are following suit.

RARRA builds better customer lifetime value by no longer placing emphasis on a customer conversion funnel. It listens and learns from user behavior, and relies on current users to encourage new users to convert. Hence, another shift in smaller or sometimes no sales teams in SaaS.

The RARRA funnel includes::

Retention: Focuses on building a customer-centric platform, with great UX/UI. It focuses on making your app a place users love.

Activation: Focuses on mapping your users’ journeys with repeat value moments. Enabling users to get their job done, go beyond that job, and discover new “aha!” moments with new tools and features.

Revenue: It’s 60-70% easier to sell to current customers than it is to new ones. It makes sense that retaining customers should be more financially viable than trying to acquire new ones.

Referral: Build products your users will love, and let them do the legwork for you. Studies show that people are 4x more likely to buy because of a recommendation from a friend or colleague than from any marketing material. Plus, it leads to a near 40% higher retention rate. Give your users the tools they need to refer your product: make it easy.

Acquisition: All of your above efforts should lead to you acquiring more customers. Sure, it may happen at a slower rate, but at a much longer lifespan. Hence, an increase in customer lifetime value.

Why is the RARRA model becoming more popular among SaaS companies? #

This revised growth model is customer-centric, bringing a microscope to your customer retention management above everything else. This, in turn, makes it ROI-centric.

RARRA tends to work well with the North Star Metric framework common among B2B SaaS brands. Recap: The North Star framework focuses on one core value metric that your product brings to users, and have that metric lead the way.

RARRA focuses more on customer lifetime value, nurturing product qualified leads (PQLs), upselling and cross-selling opportunities, building a relationship with active users, turning them into power users, and eventually product advocates. It perfectly combines product-led growth with community-led growth.

What’s more, this model works no matter where you are in your product adoption curve. Which means it’s accessible to all SaaS companies. It enables you to identify user activation milestones and “aha!” moments, and then build smoother journeys to key in-app actions which help retain your users.

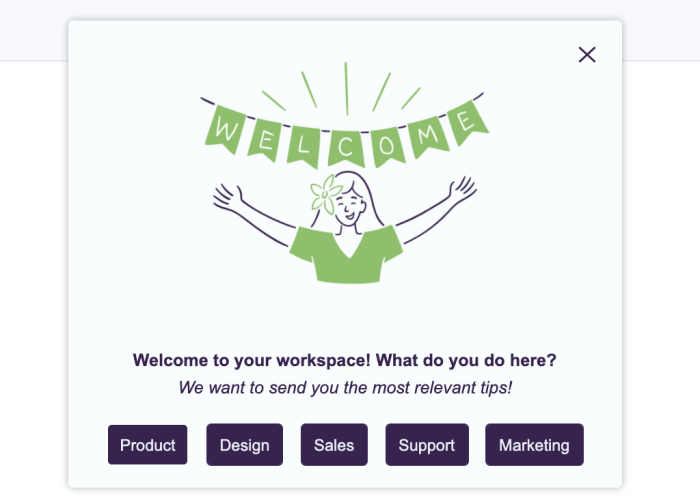

🦎 Chameleon Tip: If you’re looking to build journeys to get users to their “aha!” moments quicker, try creating custom, personalized onboarding Tours with Chameleon. Here’s an example of what the first step of a welcome Tour could look like.

AARRR vs. RARRA: What should you focus on? #

So, should you be focusing on a retention rate or an acquisition rate? What’s a vanity metric, and what’s something worth chasing that will help you see long-term product growth?

Here’s what Jane Portman, Co-Founder of Userlist and podcast host of UI Breakfast, thinks about it.

“The difference between AARRR and RARRA is about prioritizing either acquisition or retention in your efforts. If acquisition comes easy or "is built into" your product as a native distribution channel, then focusing on retention makes the most sense.”

– Jane Portman, Co-Founder of Userlist and podcast host of UI Breakfast

We also reached out to Emir Atli, Co-Founder of HockeyStack, to get his take on the “acquisition-first or retention-first” question.

“After getting 10-20 customers, I would focus on retention and the RARRA framework. Activation is a real pain for most SaaS businesses. If you figure out a way to activate users and reduce time-to-value, then getting referrals and growing your user base will be much easier.”

– Emir Atli, Co-Founder of HockeyStack

So, we’ve covered AARRR and RARRA as funnel-based growth models, but let's not forget that there are also growth loops and flywheel strategies that you can consider, especially if you run a product-led business.

Should you also add growth loops and flywheels into the mix? #

Hopefully, with the whole overview of the strategies, you’ll be able to define the better growth model for your product, with the KPIs and metrics that matter to you.

As a quick recap:

Growth loops or viral loops are an acquisition strategy that relies on referrals. For example, companies like Dropbox, Transferwise, and Uber, encourage users to distribute invites to the app and reward them with benefits (free storage, free $$$, free rides). Many B2B companies have adopted the same approach. This strategy naturally comes as part of the RARRA model.

The Flywheel model is a strategy that relies on product-led user experiences. It lets your product do the talking, rather than sales or customer success teams. It typically relies on three stages: Attract, Engage, Delight. As Cameron Deatsch, Chief Revenue Officer at Atlassian, explains in his article, “once you get the flywheel going, it takes relatively little effort to keep it spinning.”

Emir Atli and his team at HockeyStack have been successfully using loops to optimize for growth.

“Funnels always go in the same direction no matter which company you apply them to. Instead of funnels, we are creating our growth loops and flywheels as they allow us to optimize for our own growth strategy and direction.”

– Emir Atli, Co-Founder of HockeyStack

How to choose the right framework for your product growth #

That was a deep dive into AARRR vs. RARRA models, and how growth loops can accompany them. It’s time to make a decision.

For a better understanding of how these models are applied in real-life, let’s hand it over to our experts to see how their SaaS companies are handling it.

Jane Portman of Userlist explains how her team approaches this.

“Retention isn't a challenge for Userlist, because it's an email automation tool. Such long-term retention was "top of mind" when we started the business. But we can only retain users after they are activated!

Activation is a true area of focus, and both models respect activation as the second important step. Plenty of our efforts go into acquiring users, but we prefer channels that would also help activate them at the same time – primarily, educational content. So it seems that we prefer AARRR over RARRA, albeit it's not a conscious decision.”

– Jane Portman, Co-Founder of Userlist

On the other hand, Arthur Iinuma, Co-Founder and President of ISBX, says that their SaaS company is “focused on retention initiatives to promote a better business growth strategy”.

“Focusing on user retention is critical to any app. Having an established user base that drives traffic consistently is a more favorable condition than acquiring users with only "rented" traffic in the beginning. It is a superior growth strategy due to its lower attrition rate and customer acquisition costs but can deliver an upwards trend of active users over time.”

– Arthur Iinuma, Co-Founder and President of ISBX

The RARRA model is also a preferred choice of David Bitton, Co-Founder and CMO at DoorLoop.

“Overemphasis on acquisition is not beneficial to long-term growth. Acquiring customers but failing to provide value that sustains their attention and compels them to continue using your product is effectively the same as renting traffic.

By prioritizing retention, you create a customer base that sees repeated value in your product each time they use it. You end up with a group of loyal customers that allows you to leverage word-of-mouth marketing, which drives growth.

Loyal customers are more inclined to endorse you to their network and share their positive experiences with like-minded people because you've proved that you're offering and developing a product that delivers actual value.”

– David Bitton, Co-Founder and CMO at DoorLoop

Michael Knight, Founder and Growth Hacker at Incorporation Insight, explains that “the RARRA model allows SaaS companies to reap revenues and recycle them to acquire more customers, making the business better equipped for how the market today works”.

“The RARRA model is a better fit as mobile compatibility is generating dominant importance in today's modern landscape. Instead of focusing on what process comes first, the RARRA model creates a sleeker and more customized customer experience by focusing not on what comes first, but on what's important.

Through a funnel model, SaaS companies will retain existing customers by providing them with a service beyond the value of what they availed. They will also activate patronage by ensuring new users can maximize the purchase/subscription of their SaaS products, and getting these users to market for them via referrals."

– Michael Knight, Founder and Growth Hacker at Incorporation Insight

As you can see, many companies are leaning towards the RARRA metrics as a strategy for growth. But that doesn’t mean that you shouldn’t rely on pirate metrics and use the AARRR funnel to drive growth if it makes more sense for your company.

Your decision will depend on your business model, niche, and the KPIs that matter for your product. After all, you might decide that you don’t want to rely on any funnel at all. Jane Portman of Userlist shares her take on this.

“Personally, I wouldn't put these on different sides of the spectrum. After all, the chosen model doesn't define the nature of your product, it merely describes your preferred strategy of measuring growth. There are thousands of businesses out there who aren't focusing on their funnels, and they're still doing well.”

– Jane Portman, Co-Founder of Userlist

Final thoughts on the AARRR vs. RARRA dilemma #

Did you notice a trend? In the era of product-led growth, many SaaS businesses have turned to the RARRA model as a strategy that focuses on growth powered by the retention of existing customers.

Then again, the AARRR model has been around for a while, and the acquisition-first conversion funnel has proven to bring results to the majority of companies.

So what should you do?

If the AARRR model is already working for you, there’s no need for a change. But if you’re thinking that it could be working better—or working for longer—you can switch to a retention-first approach and try the RARRA model.

Either way, your final destination is growth. The only question is where you want to invest—acquisition or retention—to get there.

Boost Product-Led Growth 🚀

Convert users with targeted experiences, built without engineering